Shorting Bitcoin

Over the past 12 months, Bitcoin has experienced a meteoric rise in price:

Given the outstanding price movement, the following questions seem to naturally be raised:

- Can the price movement be explained by any fundamentals, recent developments or value propositions by something plausible, exlcuding the conveniant circular argument “the more the price goes up, the more people buy it”?

- Given a reasonable explanation, can a thesis be formed about the current price as to whether it is under, over or correctly valued?

- With the thesis in hand, can it be acted upon with the strong reservation that “the market can remain irrational longer than you can remain solvent”?

I set out to answer these questions, and in the course of my research found a community strife with scams, predatory sales tactics, outright fraud and most commonly, fear, greed and cult like behavior driven exuberance towards the inevitable ‘singularity’ - after which all fiat currency will be replaced with Bitcoin.

This is not to say the blockchain technology is mundane or trivial – it is very interesting, novel and unique, but it is outside the scope of this post to dive into. Here I will focus solely on the mechanisms of the Bitcoin financial markets. I’d like to stress here that I could easily be wrong, the Keynes quote embeds deep wisdom and this post is not meant to be construed as advice. This is the culmination of some research from an interest in financial markets, given the readily available and public data.

Is there a reasonable explanation driving this price movement?

There is plenty of information readily available describing the history of Bitcoin and other crypto currencies. I’ll focus instead on a more recent event, namely the issuing of 50 Million Tether in November 2017.

On its surface, Tether looks like an interesting idea:

- Maintain a cash reserve of USD.

- Issue an equivalent number of tokens (Tether) as the reserve of USD

Through the advent of blockchain technology, these tokens are hard (cryptographically) to counterfeit and easy to transfer. You can then bypass slow and clunky traditional banking systems (KYC, settlement delays, counterparty risk) when trying to move assets between exchanges and platforms. In theory, since there is a reserve of USD “backing” the tokens, the token remains a stable store of value.

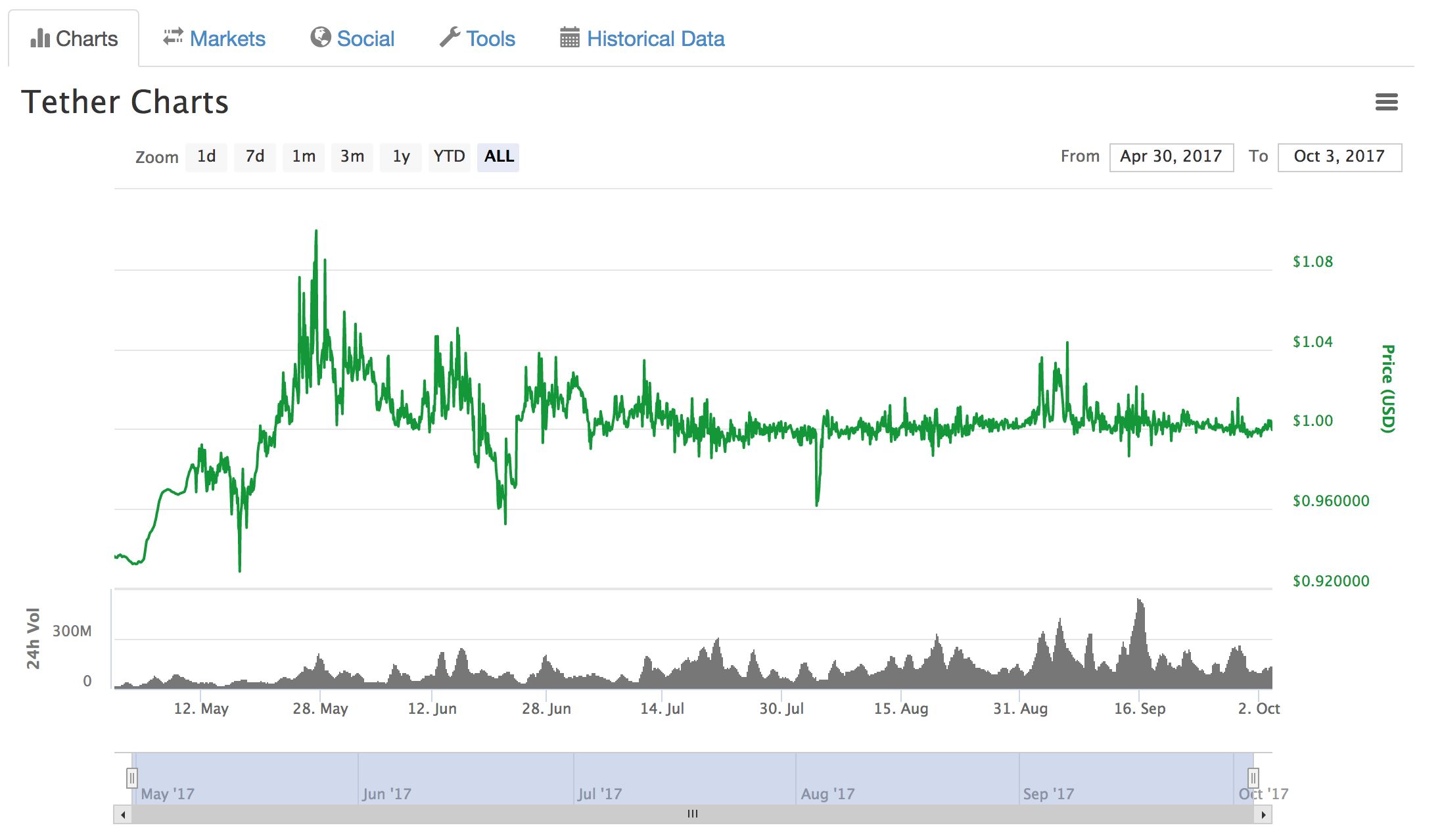

At first glance, this seems to be the case with the price staying relatively close to $1:

However, looking at the “market cap” of Tether paints a different picture:

There are few interesting things to note here. First, since 1 Tether is theoretically backed by $1 USD, a rising market cap with a relatively stable price implies two things:

- There are more Tether’s being issued.

- There are more dollars being held to back the Tether.

The rise in marketcap from about $100 Million in mid June to over $900 Million in late November could possibly be explained by the wild success of the crypto currency markets. However, on further analysis this explanation breaks down in favor of a more malicious one.

These posts:

- The Mystery of The Bitfinex/Tether bank, and why this is suspicious - Oct 1, 2017

- Bitfinex never ‘repaid’ their tokens, Bitfinex started a ponzi scheme. - Oct 28, 2017

- The Bitfinex Dilemma: Blow up now, or try a Hail-Mary to retain in business. - Nov 15, 2017

- Spoiler Alert: The ‘Institution’ buying Tethers, is Bitfinex themselves. - Dec 2, 2017

and in particular

- The Curious Tale Of Tethers - Aug 7, 2017

- Are Fraudulent Tethers being used for margin lending on Bitfinex? - Aug 16, 2017

shed light on the murky nature of Tether issuance, and its ties to the exchange Bitfinex. A summary of the findings is included below for brevity, but does not do the posts justice:

- The issuance of Tethers is directly linked to and issued by the operators of Bitfinex. (likely, sources include leaked shareholder reports and the recent paradise papers leak)

- It seems suspect that a store of value makes the legal disclaimer “There is no contractual right or other right or legal claim against us to redeem or exchange your Tethers for money.” see Section 3 “PURCHASE AND REDEMPTION OF TETHERS”

- There is lots of anecdotal evidence showing the inability to redeem Tether for USD or even to deposit USD in exchange for Tether.

- There is good reason to believe Bitfinex (via the CEO) issues new Tether in order to increase the available margin on their own exchange, likely to temporarily alleviate liquidity and reserve issues. (Lack of auditing and reserve proof)

- The availability and use of the freely available (from the point of view of Bitfinex) margin creates artificial demand for Bitcoin (and other crypto currencies), drastically inflating the price.

Is the price over, under or correctly valuing Bitcoin?

There is an argument to make that the true price of something, is exactly what the market says it is, at a given moment. This is true in the sense that, if I wanted to sell 1 Bitcoin, I would roughly be able to sell one for $11,000 at the time of writing this post.

However, prices do change, it hasn’t been shown that the Bitcoin markets have “perfect information”, that they are completley effecient and, most importantly, they are not rife with fraud. I am not a lawyer, but I have very little reason to doubt the issuance of Tether is fradulent and runs amok of existing financial regulations.

Given the issuance of Tether is inflating the price of Bitcoin, I then propose that Bitcoin is largely over valued.

Can we act on the over valuation of Bitcoin?

If you believe something is over valued, you might also believe the market will drive the price down in order to correct this misprice. There are two things to take note of.

- When will the market correct itself?

- By how much? Or put differently, by how much is Bitcoin over valued in this thesis?

These are two very difficult questions that I hope to explore further and in retrospect. As this post is not meant to be construed as financial advice, I will leave these open.

Given that we think Bitcoin is over valued and that the market will (eventually) correct itself, it seems we could trade on this thesis.

How?

Since the price of Bitcoin will decrease as it is over valued due to the huge increase in supply of Tether, we could potentially act on this information via various financial instruments such as:

- Use Derivatives (Options, Futures, CFD)

- Short Bitcoin

- Short an asset that tracks Bitcoin (ex. an ETF)

- Buy something inversely correlated with the price of Bitcoin.

Use Derivatives

From my findings, the first legally authorized and certified exchange to trade Bitcoin derivatives is LedgerX. Likely to protect consumers and for regulatory reasons, they have stringent capital requirements – $10M for an individual investor.

This is prohibitive for most people to speculate on the over valuation of Bitcoin.

A CFD (Contract For Differences) is another potential option to bet against the price of Bitcoin. However, there did not seem to be any practical US based choices to enter into such a contract.

IG, in their Singapore markets, seems to offer the ability to purchase such a contract. Counterparty risk should be considered very seriously, along with the very real possibility and impact of black swan events.

Short Bitcoin

While there seem to be some reputable exchanges that allow you to short bitcoin, the more reputable (Coinbase/GDAX) also have stringent capital requirements.

BitFlyer is an exchange available to US customers, but I have no knowledge of their reputation or operations.

Short an Asset that Tracks Bitcoin

There are two major ETF’s with exposure to Bitcoin, GBTC and ARKW.

GBTC

While this is a vehicle to potentially bet on the downard price movement of Bitcoin, there are a few things to make note of:

- The ETF trades relative to its NAV at a huge premium (~70% at the time of this writing).

- While there is short interest, it is low to the outstanding shares available. This could make it difficult to find shares to borrow.

- The ETF is OTC, creating liquidity and other risks.

ARKW

While ARKW is listed on major exchanges, there are also a few caveats with shorting this ETF:

- Its exposure is not to Bitcoin directly, but instead to GBTC.

- Of the entire fund, ~6% of its assets are held in GBTC. The rest of the fund is heavily weighted toward the technology sector. This limits the actual Bitcoin exposure you would get by taking a short position against it, while also introducing other risks (namely, exposure to the technology sector).

Conclusions

Through the course of this research, I’ve found what seems to be good reason to believe Bitcoin is over valued, likely because of the fradulent issuance of Tether. It does not seem there are practical and convenient ways for the average investor to safely (avoid risks except the risk of being wrong about the price) and lawfully speculate on this belief. There are also still open questions on the execution (timing and magnitude) of such a trade.

Luckily, we will be able to judge the validity of this thesis over time - and maybe even find answers and solutions to the unresolved issues above.